Learn To Invest

Taking control of your wealth plan

Our Quality of Life improves when our financial knowledge increases.

When it comes to determining your Quality of Life, having a solid plan and access to financial resources are key ingredients for success. Building a strong wealth strategy entails having access to the right information and expert guidance. Being armed with the right knowledge can lead to stronger financial decision-making.

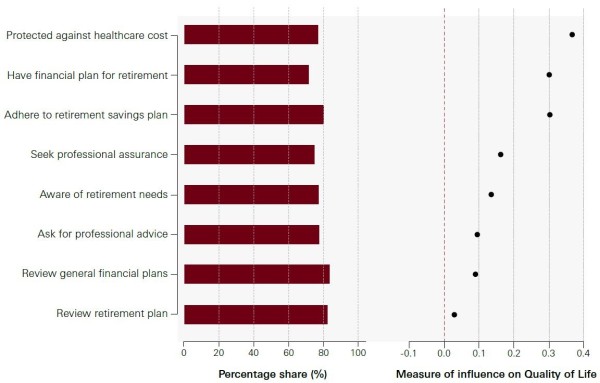

Zooming in on personal planning

Percentage share of individuals answering ‘yes’ to various components of financial planning, and how each component is associated with overall Quality of Life.

A key aspect of effective wealth management is diversification. Research has shown that including a broader range of investments in a wealth portfolio can help create a solid financial foundation that supports both stability and growth. By embracing a broader range of investment opportunities, individuals can position themselves for long-term success and better navigate the ever-changing world of finance with confidence.

A key aspect of effective wealth management is diversification. Research has shown that including a broader range of investments in a wealth portfolio can help create a solid financial foundation that supports both stability and growth. By embracing a broader range of investment opportunities, individuals can position themselves for long-term success and better navigate the ever-changing world of finance with confidence.

Jan-Marc Fergg, Global Head of ESG & Managed Solutions, HSBC

Early investment

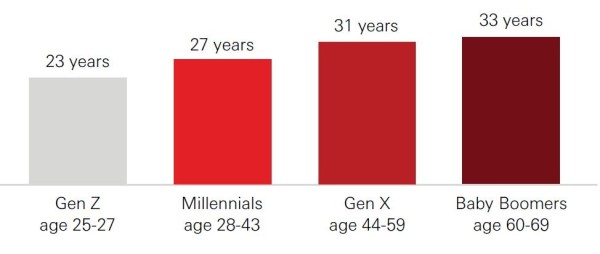

Younger generations are starting to invest earlier

Average age to start investing

The HSBC Quality of Life Report 2024 highlights the significance of investing early. Gen Z and Millennials, on average, start investing earlier (at 23 and 27 years old, respectively) than Gen X (31) and Baby Boomers (33). The report also reveals that they invest a higher portion of their income and tend to monitor their portfolios more frequently. This active interest in investing contributes to a sense of control and well-being.

Practical steps to boost your financial well-being

Your Quality of Life could be improved with a robust financial plan. Consider these five practical steps when planning the financial future for yourself and your loved ones.

1. Improve your financial knowledge

Take the time to understand the various investment options available to you. This knowledge could empower you to make informed decisions about your portfolio and financial plan. Building a firm understanding of wealth management helps lay a solid foundation for future financial security.

Think big, start small. One of the key steps towards securing your financial future is to start investing. After assessing your financial goals and risk tolerance, take the first step on your investment journey.

3. Explore diversification

Investing in a variety of markets or asset classes could help you capture opportunities and be more resilient against market volatility.

Consult with financial specialists and establish a plan, then review it regularly to ensure it covers your present and future needs.

Your Quality of Life can decline as you go through different stages of life. Making sure you are covered for potential setbacks with a robust financial plan can help you ride out any future bumps in the road.

Seeing the connection between resilience, portfolio diversification and Quality of Life is crucial.

By understanding the importance of resilient financial planning, individuals can become more financially secure and prepared for the future, able to embrace new opportunities with more confidence.

Prioritising peace of mind and taking practical steps to enhance financial knowledge can help establish robust plans and raise overall Quality of Life. By adopting these strategies, individuals can navigate uncertainties with increased confidence, paving the way for a more secure and prosperous future.

网址:Learn To Invest https://www.yuejiaxmz.com/news/view/42947

相关内容

How to prepare and invest for retirement雅思写作社会生活/职场类:换工作的原因?对社会发展有积极影响吗?

unable to access jarfile

生活不只是生存:教你学会生活的30种方式(二)(打印版)

双语:必知的15个保养男式衣物小窍门

小红书 – 你的生活指南

给毕业生的4个理财小贴士

享受生活的30种简单方方法

APP篇

水肺潜水员