家庭健身应用市场按类型(饮食与营养、活动追踪、锻炼与运动、生活方式管理、其他(冥想与瑜伽等)、平台(Android、iOS)、设备(智能手机、平板电脑、可穿戴设备)和地区划分,全球趋势及 2023 年至 2030 年预测

'科技与健身:智能穿戴设备监测运动健康' #生活乐趣# #生活分享# #城市生活观察# #生活科技趋势#

家庭健身应用市场概览

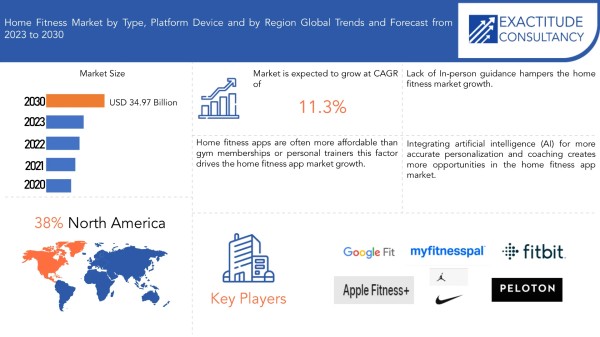

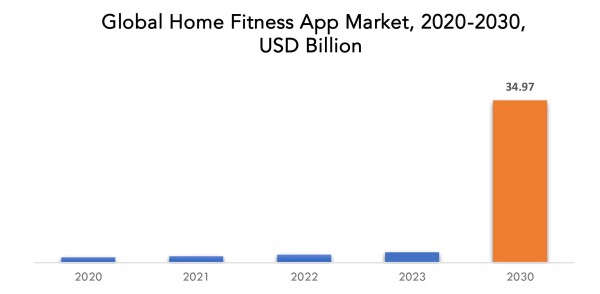

预计全球家庭健身应用市场将从 2023 年的 22.4 亿美元增长到 2030 年的 349.7 亿美元,预测期内的复合年增长率为 11.3%。

家庭健身是指在自己家中锻炼和保持身体健康的做法。这种健身方式近年来广受欢迎,原因包括便利性、成本效益以及支持家庭锻炼的技术的可用性。家庭健身应用允许用户在适合自己日程安排的任何时间锻炼,无需通勤到健身房或参加健身课。它们为生活繁忙的用户提供了灵活性,使他们更容易保持一致的锻炼习惯。许多家庭健身应用提供免费版本或负担得起的订阅选项,让更广泛的受众可以健身。家庭健身应用通常包括视频演示和锻炼的分步说明,帮助用户以正确的形式和技巧进行运动。许多应用程序都提供进度跟踪功能,让用户可以监控自己的健身成果、跟踪卡路里燃烧情况并查看一段时间内的进步情况。家庭健身应用程序通常包含激励功能,例如挑战、奖励和社交分享。用户可以与朋友或志同道合的人建立联系,从而培养动力和责任感。家庭健身应用程序为锻炼提供了一个私密而舒适的环境,这对那些在健身房环境中感到不自在的人来说很有吸引力。[caption id="attachment_34437" align="aligncenter" width="1920"]

[/caption] 几乎任何拥有智能手机或平板电脑的人都可以使用家庭健身应用。它们迎合所有健身水平的人,从初学者到高级运动员,使健身更具包容性。许多家庭健身应用提供免费版本或价格合理的订阅计划,而健身房会员或私人教练的持续费用则更高。这种成本效益使健身对用户来说更实惠、更可持续。家庭健身应用提供多种锻炼选择,包括有氧运动、力量训练、瑜伽、普拉提、HIIT 等。用户可以探索不同的锻炼方式,以防止无聊并根据自己的喜好调整锻炼计划。家庭健身应用通常根据个人目标、健身水平和可用设备提供个性化的锻炼建议和计划。这种量身定制可以增强用户体验并提高对健身计划的遵守。这些应用程序通常包括视频演示和详细的锻炼说明,确保用户以正确的形式和技巧进行运动。这种指导对初学者特别有价值。许多应用程序都提供进度跟踪功能,允许用户监控他们的健身成果、跟踪卡路里燃烧情况并查看随着时间的推移而取得的进步。这种数据驱动的方法可以激励用户坚持健身目标。家庭健身应用程序包含激励功能,例如挑战、奖励和社交分享。用户可以与朋友或志同道合的人建立联系,从而培养动力和责任感。在家锻炼提供了一个私密而舒适的环境,这对那些在健身房环境中感到不自在或不舒服的人来说很有吸引力。家庭健身应用程序通过提供明确的指示并降低因不正确的姿势或过度举重而导致受伤的风险来促进安全锻炼。世界各地的个人都可以访问家庭健身应用程序,为偏远或服务不足地区的人们提供健身指导。许多应用程序与可穿戴健身设备和智能手机集成,使用户可以无缝跟踪他们的进度和健康指标。除了锻炼之外,家庭健身应用程序通常还包括有关营养、健康和生活方式的教育内容,促进整体健康和幸福。家庭健身应用程序开发人员不断创新,推出新功能、新技术和锻炼方式,以保持用户的参与度和积极性。

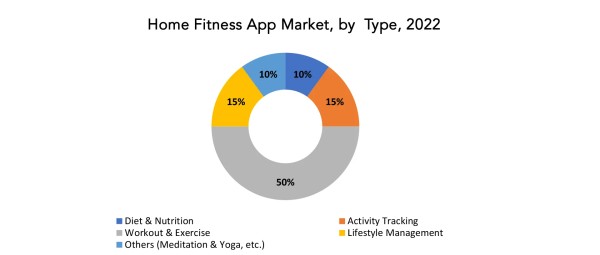

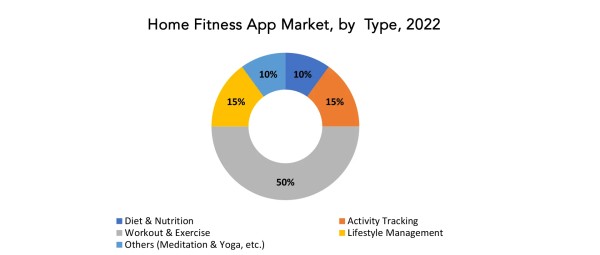

属性细节学习期限2020-2030基准年2022预计年份2023预测年份2023-2030历史时期2019-2021单元价值(十亿美元)分割按类型、平台、设备和地区按类型饮食与营养

活动追踪

健身与运动

生活方式管理

其他(冥想和瑜伽等)

按平台

安卓

iOS

按设备

手机

药片

可穿戴

按地区

北美

亚太地区

欧洲

南美洲

中东、亚洲和非洲

Home Fitness Apps Market Segmentation Analysis

The global Home Fitness App market is divided into 4 segments Type, platform, Devices, and region. by type the market is bifurcated into Diet & Nutrition, Activity Tracking, Workout & Exercise, Lifestyle Management, Others (Meditation & Yoga, etc.). By platform the market is bifurcated into Android, iOS. By device the market is bifurcated into Smartphone, Tablet, Wearable Devices. [caption id="attachment_34465" align="aligncenter" width="1920"]

[/caption] Based on type workout exercise segment dominating in the home fitness app market. People have diverse fitness goals, including weight loss, muscle building, cardiovascular health, flexibility, and stress reduction. The workout exercise segment caters to a wide range of goals, allowing users to choose workouts that align with their specific objectives. Many home fitness apps in the workout exercise segment provide customization options, enabling users to tailor their workout plans based on fitness level, available time, and preferences. This flexibility enhances the user experience. Workout exercises are accessible to individuals of all fitness levels, from beginners to advanced athletes. Users can choose workouts that match their current abilities and progressively increase intensity as they improve. Home fitness apps in this segment often include guided workout videos or audio instructions led by certified fitness instructors or trainers. These guides ensure users perform exercises with proper form and technique, reducing the risk of injury. Users can track their workout progress, monitor their performance, and visualize improvements over time. Progress tracking provides motivation and accountability, encouraging users to stick to their fitness routines. Workout exercise apps typically incorporate motivational features, such as challenges, goal-setting, rewards, and leaderboards. These elements foster motivation and friendly competition among users. Many apps encourage community engagement, allowing users to connect with friends, share achievements, and participate in social fitness challenges. A supportive community enhances motivation and accountability. The workout exercise segment often integrates popular fitness trends and workout styles, staying aligned with industry developments and user preferences. [caption id="attachment_34492" align="aligncenter" width="1920"]

[/caption] Based on device type Smartphone segment dominating in the home fitness app market. Smartphones are nearly ubiquitous, with a large percentage of the global population owning and using them. This wide adoption ensures that home fitness apps are readily accessible to a vast audience. Smartphones serve multiple purposes, including communication, entertainment, and productivity. By incorporating fitness apps into their smartphones, users can consolidate various functions into a single device. Many fitness apps include social and community features that allow users to connect with others, share their progress, and participate in challenges or virtual fitness classes. This sense of community can be motivating and enjoyable. Home fitness apps can track users' workout history, monitor progress, and provide insights into their fitness journey. Users appreciate the ability to visualize their improvements over time. Compared to dedicated fitness equipment, smartphones are relatively affordable, making them an attractive option for those looking to start or maintain a home fitness routine without significant upfront costs. App developers continuously update and improve their fitness apps, adding new features, workouts, and capabilities. This ongoing development keeps users engaged and encourages them to stick with their fitness routines. [caption id="attachment_34467" align="aligncenter" width="1920"]

[/caption]

Home Fitness Apps Market TrendsAI can analyze user data, including fitness goals, preferences, and performance history, to generate tailored workout plans. This personalization ensures that users receive workouts that align with their specific needs and objectives.AI-powered virtual trainers can provide real-time guidance and feedback during workouts. These AI coaches can adapt the intensity and difficulty of exercises based on users' capabilities, ensuring a safe yet challenging experience.AI can monitor and analyze user progress more comprehensively, offering insights into areas of improvement and helping users set achievable goals.AI can provide personalized nutrition recommendations and meal plans, taking into account users' dietary preferences and fitness goals. It can also track users' food intake and suggest adjustments.AI can analyze user behavior and engagement patterns to identify potential barriers to consistency and motivation. It can then provide tailored strategies to help users stay committed to their fitness routines.AI can detect risky exercise practices and improper form, offering real-time corrections and injury prevention tips to users, reducing the likelihood of injuries during workouts.AI-powered chatbots and conversational interfaces can engage users in meaningful conversations, answer questions, offer motivation, and provide support, contributing to higher user retention rates.AI can connect users with similar fitness interests and goals, facilitating virtual communities within the app. This fosters a sense of belonging and encourages users to stay engaged.AI can incorporate voice and visual recognition technologies to ensure users are performing exercises correctly and following instructions accurately.AI can bolster data security by identifying potential security threats and vulnerabilities, helping to protect user data and privacy.AI algorithms can recommend relevant workout videos, exercises, and fitness content, improving user engagement and satisfaction.AI can seamlessly integrate with wearable fitness devices, providing real-time data synchronization and more accurate health and fitness insights. Competitive LandscapeThe competitive landscape of the home fitness app market is characterized by a diverse range of players, including established fitness brands, tech companies, startups, and independent developers. These companies compete to offer users innovative, effective, and engaging fitness solutions

PelotonFitbit (now part of Google)MyFitnessPal (Under Armour)Nike Training ClubApple Fitness+Google FitSamsung HealthYoga for BeginnersCalmHeadspaceStravaFitbodJEFITFreeleticsAaptivBeachbody On DemandLose It!MyPlate by LivestrongZwiftFitOn Recent Developments:April 2020 - Samsung Electronics Co. Ltd. collaborated with the fitness companies Calm, barre3, Echelon, obé Fitness, Fitplan, and Jillian Michaels Fitness to add wellness applications to its smart TV platform. November 2019: Fitbit, Inc., a manufacturer of fitness trackers and wearable technology, has been acquired by Google LLC for US$ 2.1 billion.

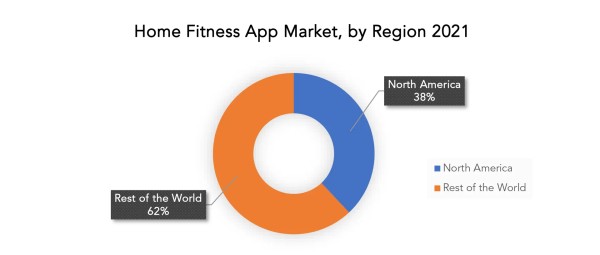

Regional Analysis North America accounted for the largest market in the Home Fitness App market. North America accounted for the 38 percent market share of the global market value. North America often leads in the adoption of fitness trends and innovations. Home fitness apps have gained traction quickly, aligning with the region's openness to trying new fitness technologies and solutions. The region has a tech-savvy population with widespread access to smartphones, tablets, and other devices. This tech readiness makes it easier for people to embrace and use home fitness apps. Several well-established fitness and tech companies based in North America, such as Peloton, Fitbit, and Apple, have launched or expanded their home fitness app offerings, contributing to the market's growth. Home fitness apps are often heavily marketed and advertised in North America, reaching a broad audience and creating awareness about their benefits. The availability of high-speed internet connections in North America ensures that users can stream workouts and access content seamlessly, enhancing the overall user experience. Growing health and wellness trends, including a focus on physical fitness and mental well-being, drive the demand for home fitness apps that offer comprehensive fitness and mindfulness solutions. [caption id="attachment_34479" align="aligncenter" width="1920"]

[/caption] The COVID-19 pandemic accelerated the adoption of home fitness apps as people sought alternatives to traditional gyms and fitness studios. This trend is likely to have a lasting impact on the market's growth. The region has a competitive landscape with a mix of established players, startups, and innovative tech companies continuously launching and expanding their home fitness app offerings. The presence of venture capital, tech hubs, and innovation centers in North America fuels investment and innovation in the fitness tech sector, leading to the development of cutting-edge home fitness apps.

Target Audience for Home Fitness Apps MarketGeneral Fitness EnthusiastsBeginners and NovicesWeight Loss SeekersStrength and Muscle BuildersCardiovascular HealthYoga and Mindfulness EnthusiastsSeniors and Older AdultsPregnant and Postpartum WomenAthletes and Sports EnthusiastsBusy ProfessionalsTravelersRehabilitation and Injury RecoveryFitness Tech EnthusiastsSocial and Community-Oriented UsersFitness ProfessionalsWellness and Mental Health Seekers Import & Export Data for Home Fitness App MarketExactitude consultancy provides import and export data for the recent years. It also offers insights on production and consumption volume of the product. Understanding the import and export data is pivotal for any player in the Home Fitness App Market. This knowledge equips businesses with strategic advantages, such as:

Identifying emerging markets with untapped potential.Adapting supply chain strategies to optimize cost-efficiency and market responsiveness.Navigating competition by assessing major players' trade dynamics. Key insightsTrade volume trends: our report dissects import and export data spanning the last five years to reveal crucial trends and growth patterns within the global Home Fitness App Market. This data-driven exploration empowers readers with a deep understanding of the market's trajectory.Market players: gain insights into the leading players driving the Surgical Drill trade. From established giants to emerging contenders, our analysis highlights the key contributors to the import and export landscape.Geographical dynamics: delve into the geographical distribution of trade activities. Uncover which regions dominate exports and which ones hold the reins on imports, painting a comprehensive picture of the industry's global footprint.Product breakdown: by segmenting data based on Surgical Drill types –– we provide a granular view of trade preferences and shifts, enabling businesses to align strategies with the evolving technological landscape.Import and export data is crucial in reports as it offers insights into global market trends, identifies emerging opportunities, and informs supply chain management. By analyzing trade flows, businesses can make informed decisions, manage risks, and tailor strategies to changing demand. This data aids governments in policy formulation and trade negotiations, while investors use it to assess market potential. Moreover, import and export data contributes to economic indicators, influences product innovation, and promotes transparency in international trade, making it an essential Storage Capacity for comprehensive and informed analyses.

Segments Covered in the Home Fitness Apps Market ReportHome Fitness Apps Market by Type, 2020-2030, (USD Billion)

Diet & NutritionActivity TrackingWorkout & ExerciseLifestyle ManagementOthers (Meditation & Yoga, etc.)Home Fitness Apps Market by Platform, 2020-2030, (USD Billion)

AndroidiOSHome Fitness Apps Market by Device, 2020-2030, (USD Billion)

SmartphoneTabletWearableHome Fitness Apps Market by Region, 2020-2030, (USD Billion)

North AmericaEuropeAsia PacificSouth AmericaMiddle East and Africa介绍

MARKET DEFINITION

MARKET SEGMENTATION

RESEARCH TIMELINES

ASSUMPTIONS AND LIMITATIONS

RESEARCH METHODOLOGY

DATA MINING

SECONDARY RESEARCH

PRIMARY RESEARCH

SUBJECT-MATTER EXPERTS’ ADVICE

QUALITY CHECKS

FINAL REVIEW

DATA TRIANGULATION

BOTTOM-UP APPROACH

TOP-DOWN APPROACH

RESEARCH FLOW

DATA SOURCES

EXECUTIVE SUMMARY

MARKET OVERVIEW

HOME FITNESS APP MARKET OUTLOOK

MARKET DRIVERS

MARKET RESTRAINTS

MARKET OPPORTUNITIES

IMPACT OF COVID-19 ON HOME FITNESS APP MARKET

PORTER’S FIVE FORCES MODEL

THREAT FROM NEW ENTRANTS

THREAT FROM SUBSTITUTES

BARGAINING POWER OF SUPPLIERS

BARGAINING POWER OF CUSTOMERS

DEGREE OF COMPETITION

INDUSTRY VALUE CHAIN ANALYSIS

GLOBAL HOME FITNESS APP MARKET BY TYPE, 2020-2030, (USD BILLION)

DIET & NUTRITION

ACTIVITY TRACKING

WORKOUT & EXERCISE

LIFESTYLE MANAGEMENT

OTHERS (MEDITATION & YOGA, ETC.)

GLOBAL HOME FITNESS APP MARKET BY PLATFORM, 2020-2030, (USD BILLION)

ANDROID

IOS

GLOBAL HOME FITNESS APP MARKET BY DEVICE, 2020-2030, (USD BILLION)

SMARTPHONE

TABLET

WEARABLE

GLOBAL HOME FITNESS APP MARKET BY REGION, 2020-2030, (USD BILLION)

NORTH AMERICA

US

CANADA

MEXICO

SOUTH AMERICA

BRAZIL

ARGENTINA

COLOMBIA

REST OF SOUTH AMERICA

EUROPE

GERMANY

UK

FRANCE

ITALY

SPAIN

RUSSIA

REST OF EUROPE

ASIA PACIFIC

INDIA

CHINA

JAPAN

SOUTH KOREA

AUSTRALIA

SOUTH-EAST ASIA

REST OF ASIA PACIFIC

MIDDLE EAST AND AFRICA

UAE

SAUDI ARABIA

SOUTH AFRICA

REST OF MIDDLE EAST AND AFRICA

COMPANY PROFILES*

(BUSINESS OVERVIEW, COMPANY SNAPSHOT, PRODUCTS OFFERED, RECENT DEVELOPMENTS)

PELOTON

FITBIT (NOW PART OF GOOGLE)

MYFITNESSPAL (UNDER ARMOUR)

NIKE TRAINING CLUB

APPLE FITNESS+

GOOGLE FIT

SAMSUNG HEALTH

YOGA FOR BEGINNERS

CALM

HEADSPACE

STRAVA

FITBOD

JEFIT

FREELETICS

AAPTIV

BEACHBODY ON DEMAND

LOSE IT!

MYPLATE BY LIVESTRONG

ZWIFT

FITON *THE COMPANY LIST IS INDICATIVE

LIST OF TABLES

TABLE 1 GLOBAL MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 2 GLOBAL MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 3 GLOBAL MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 4 GLOBAL MOBILE FITNESS APP MARKET BY REGION (USD BILLION) 2020-2030

TABLE 5 NORTH AMERICA MOBILE FITNESS APP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 6 NORTH AMERICA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 7 NORTH AMERICA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 8 NORTH AMERICA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 9 US MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 10 US MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 11 US MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 12 CANADA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 13 CANADA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 14 CANADA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 15 MEXICO MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 16 MEXICO MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 17 MEXICO MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 18 SOUTH AMERICA MOBILE FITNESS APP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 19 SOUTH AMERICA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 20 SOUTH AMERICA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 21 SOUTH AMERICA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 22 BRAZIL MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 23 BRAZIL MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 24 BRAZIL MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 25 ARGENTINA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 26 ARGENTINA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 27 ARGENTINA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 28 COLOMBIA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 29 COLOMBIA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 30 COLOMBIA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 31 REST OF SOUTH AMERICA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 32 REST OF SOUTH AMERICA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 33 REST OF SOUTH AMERICA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 34 ASIA-PACIFIC MOBILE FITNESS APP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 35 ASIA-PACIFIC MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 36 ASIA-PACIFIC MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 37 ASIA-PACIFIC MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 38 INDIA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 39 INDIA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 40 INDIA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 41 CHINA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 42 CHINA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 43 CHINA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 44 JAPAN MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 45 JAPAN MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 46 JAPAN MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 47 SOUTH KOREA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 48 SOUTH KOREA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 49 SOUTH KOREA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 50 AUSTRALIA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 51 AUSTRALIA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 52 AUSTRALIA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 53 SOUTH-EAST ASIA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 54 SOUTH-EAST ASIA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 55 SOUTH-EAST ASIA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 56 REST OF ASIA PACIFIC MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 57 REST OF ASIA PACIFIC MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 58 REST OF ASIA PACIFIC MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 59 EUROPE MOBILE FITNESS APP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 60 EUROPE MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 61 EUROPE MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 62 EUROPE MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 63 GERMANY MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 64 GERMANY MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 65 GERMANY MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 66 UK MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 67 UK MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 68 UK MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 69 FRANCE MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 70 FRANCE MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 71 FRANCE MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 72 ITALY MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 73 ITALY MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 74 ITALY MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 75 SPAIN MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 76 SPAIN MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 77 SPAIN MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 78 RUSSIA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 79 RUSSIA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 80 RUSSIA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 81 REST OF EUROPE MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 82 REST OF EUROPE MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 83 REST OF EUROPE MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 84 MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY COUNTRY (USD BILLION) 2020-2030

TABLE 85 MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 86 MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 87 MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 88 UAE MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 89 UAE MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 90 UAE MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 91 SAUDI ARABIA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 92 SAUDI ARABIA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 93 SAUDI ARABIA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 94 SOUTH AFRICA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 95 SOUTH AFRICA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 96 SOUTH AFRICA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

TABLE 97 REST OF MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY TYPE (USD BILLION) 2020-2030

TABLE 98 REST OF MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY DEVICE (USD BILLION) 2020-2030

TABLE 99 REST OF MIDDLE EAST AND AFRICA MOBILE FITNESS APP MARKET BY PLATFORM (USD BILLION) 2020-2030

LIST OF FIGURESFIGURE 1 MARKET DYNAMICS

FIGURE 2 MARKET SEGMENTATION

FIGURE 3 REPORT TIMELINES: YEARS CONSIDERED

FIGURE 4 DATA TRIANGULATION

FIGURE 5 BOTTOM-UP APPROACH

FIGURE 6 TOP-DOWN APPROACH

FIGURE 7 RESEARCH FLOW

FIGURE 8 GLOBAL HOME FITNESS APP MARKET BY TYPE USD BILLION, 2020-2030

FIGURE 9 GLOBAL HOME FITNESS APP MARKET BY PLATFORM, USD BILLION, 2020-2030

FIGURE 10 GLOBAL HOME FITNESS APP MARKET BY DEVICE, USD BILLION, 2020-2030

FIGURE 11 GLOBAL HOME FITNESS APP MARKET BY REGION, USD BILLION, 2020-2030

FIGURE 12 PORTER’S FIVE FORCES MODEL

FIGURE 13 GLOBAL HOME FITNESS APP MARKET BY TYPE, USD BILLION 2022

FIGURE 14 GLOBAL HOME FITNESS APP MARKET BY PLATFORM, USD BILLION 2022

FIGURE 15 GLOBAL HOME FITNESS APP MARKET BY DEVICE, USD BILLION 2022

FIGURE 16 GLOBAL HOME FITNESS APP MARKET BY REGION, USD BILLION 2022

FIGURE 17 MARKET SHARE ANALYSIS

FIGURE 18 PELOTON: COMPANY SNAPSHOT

FIGURE 19 FITBIT: COMPANY SNAPSHOT

FIGURE 20 MYFITNESSPAL: COMPANY SNAPSHOT

FIGURE 21 NIKE TRAINING CLUB: COMPANY SNAPSHOT

FIGURE 22 APPLE FITNESS+: COMPANY SNAPSHOT

FIGURE 23 GOOGLE FIT: COMPANY SNAPSHOT

FIGURE 24 SAMSUNG HEALTH: COMPANY SNAPSHOT

FIGURE 25 YOGA FOR BEGINNERS: COMPANY SNAPSHOT

FIGURE 26 CALM: COMPANY SNAPSHOT

FIGURE 27 HEADSPACE: COMPANY SNAPSHOT

FIGURE 28 STRAVA: COMPANY SNAPSHOT

FIGURE 29 FITBOD: COMPANY SNAPSHOT

FIGURE 30 JEFIT: COMPANY SNAPSHOT

FIGURE 31 FREELETICS: COMPANY SNAPSHOT

FIGURE 32 AAPTIV: COMPANY SNAPSHOT

FIGURE 33 ZWIFT: COMPANY SNAPSHOT

FIGURE 34 MYPLATE BY LIVESTRONG: COMPANY SNAPSHOT

FIGURE 35. BEACHBODY ON DEMAND: COMPANY SNAPSHOT

FIGURE 36 FITON: COMPANY SNAPSHOT

网址:家庭健身应用市场按类型(饮食与营养、活动追踪、锻炼与运动、生活方式管理、其他(冥想与瑜伽等)、平台(Android、iOS)、设备(智能手机、平板电脑、可穿戴设备)和地区划分,全球趋势及 2023 年至 2030 年预测 https://www.yuejiaxmz.com/news/view/574059

相关内容

可穿戴设备登顶,2023全球健身行业刮起“监测风”?丨即氪健身 Vol.34基于可穿戴设备的运动追踪与健身指导

2022年全球健身趋势调查

2021年全球健身趋势调查

智能可穿戴设备夯实主动健康管理新赛道

健身智能家居设备

可穿戴健身设备

2023智能健身设备行业市场竞争分析与趋势预测

AI与可穿戴设备:开启健康管理私人定制新时代

这五款智能可穿戴设备,为缓解压力而生 – 镁客网