关于“高股息策略”,巴菲特跟你有不同的想法(附:致股东信中关于“股息”的讨论) (全文共2600字,大约阅读8分钟)目录1.关于“股息”的基本常识2.什么是“高股息策略”3.“高股息策略”对投资者的好...

1.关于“股息”的基本常识

2.什么是“高股息策略”

3.“高股息策略”对投资者的好处

4.“高股息策略”的替代——“抛售策略”

附:巴菲特《致伯克希尔股东的信》中对“股息”的讨论

关于"股息"的基本常识1. 什么是股息?股息是公司向股东分配的红利,钱通常来自公司利润的一部分。

2. 公司为什么要支付股息?一家公司可以利用其利润做四件事:

(1)对公司进行再投资(即自我的内生增长)

提高效率,扩大市场份额,构建企业发展护城河……这些都是管理层需要思考的最基本的问题。当企业获得利润或现金流时,首先应该想到的就是如何进一步发展自身业务,让自己变得更好。

(2)收购其他公司

著名的巴菲特所管理的伯克希尔,就时常将大量资金用于收购——“相比于将资金用于股票回购或者分红,将资金用于收购可以使股东富有得多”。

(3)回购股份

当公司认为其目前的股票价格远低于公司的内在价值时,他们就可能采取第3点——股份回购。比如从8月28日开始,【腾讯控股700.HK】连续27个交易日进行回购,累计花费约10.06亿港元,约合9.17亿元人民币。

(4)支付股息

这通常是经营稳定、现金流充裕的大型公司会做的事情——作为业务稳定的“现金奶牛”,他们自然愿意把利润的一部分回馈给股东。另外一方面,这类公司的股票价格不一定成长性很高。因此,为了吸引股东,他们派发股息来使公司的股票变得有吸引力。

股东毕竟是公司的所有者,应从利润中受益。如果某些上市公司明明有充足的现金,却只放在银行,那么会引起投资者的猜测——是不是未来将有大型的并购或者其他动作。如果事实不是这样,那么常年不分红的高现金公司会让投资者不满,甚至怀疑财务造假。

股息率(TTM)=近12个月内公司的累计分红总额/公司总市值

股息率是高股息策略(或者叫红利策略)最常用的选股指标。

还有一个概念叫分红率(股息支付率)

分红率=会计周期内公司股息支付总额/公司净利润

这个指标在投资时不太用。

什么是高股息策略?当人们第一次涉足高股息投资时,他们倾向于寻找那些以股票价格的百分比支付高股息的股票。

然而投资并非这么简单。毕竟,6%的股息率在股价下跌40%时不值一提。

当我以“高股息”为起点选择投资标的时,我未来的实际的整体投资回报率来自哪里?

——预期股息率

——预期盈利增长率

——预期市盈率的变化

如何理解这三个变量?

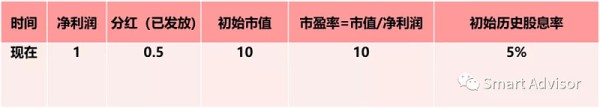

我们来做个假设:假设买了一个公司的股票,这个公司上一期分红率(=派发的股息/净利润)为50%,上一年净利润为1亿,也就是分了0.5亿给股东。

而我们购买股票时,公司市值为10亿,对应股息率就是5%。

情景1:假设分红政策不变(即分红率不变),盈利增长率为0,市盈率变化为0

情景1是四个情景中最能证明“高股息策略”有效的场景——在企业分红政策稳定或者可预测的情况下,即使未来公司盈利增长率为0,市盈率不变,那么我们还是能够拿到5%的回报率。

但是,你肯定也发现了,这个5%的回报率是蕴含着如下假设的,这也是运用“高股息策略”时,需要注意的变量:

① 分红政策稳定或者可预测(因为我们手上只有历史股息率数据)

这就要求我们选择标的时,公司的股息政策应始终清晰,一致和合理。

② 市盈率不一定要低估,但是需要较为稳定

③ 公司不一定要有高的盈利增长率,但是盈利也要稳定

总之,对于“高股息策略”来说……

以下三个情景证明了:“高股息策略”并非绝对NO.1策略。

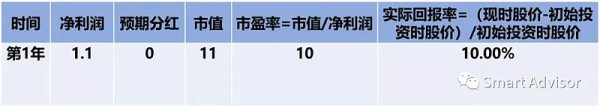

情景2:假设不分红,盈利增长率为10%,市盈率变化为0

情景3:假设不分红,盈利增长率为0,市盈率变化为10%

情景4:假设不分红,盈利增长率为10%,市盈率变化为10%(戴维斯双击)

从以上三个情景中可以看出,即使我们选择了不分红的股票,但是只要企业盈利是增长的,或者代表市场情绪的市盈率是增长的,还是能够赚钱。

尽管如此,“高股息”的标的仍然非常受投资者的欢迎。这是为什么呢?

高股息策略对于投资者的好处1. 高股息策略在熊市中通过股利再投资收益缓和股价下跌带来的投资损失,起到熊市保护伞的作用。

其中,股利再投资是“高股息策略”的核心法宝。

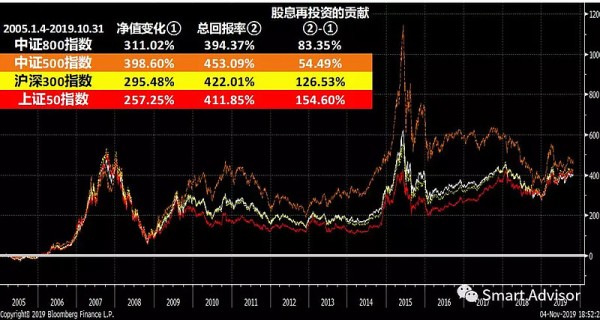

比如,我们之前整理了几大指数成立以来的回报率,发现本来【上证50指数】的净值回报率是低于【中证800指数】的,但由于“股利再投资”的效果,使得其总回报率超过了【中证800指数】。

2. 对于分红政策和盈利稳定的股票来说,当股息率(股息/股价)变高时,是其股价目前被低估的强有力的信号。

3. 对于风格比较稳健,或者某项资金需要用于养老金储蓄或者教育金储蓄的投资者来说,他们对于未来收益的确定性要求更大。在这种情况下,配置长期稳定“高股息”的股票或者“高股息策略”的基金是明智的选择。

以上三点,我们会在之后盘点“高股息指数基金/ETF”时,进行验证,提供进一步的投资建议。

“高股息策略”的替代——“抛售策略”2012年《致伯克希尔股东的信》中,巴菲特花了比较大的篇幅分享了他对于“股息”的认识。

同时,他还举了一个例子,来佐证他的观点:“抛售策略”将为股东带来明显优于“高股息策略”的业绩。

给大家演示一下巴菲特所举的例子

假设如下:(小部分假设相较于原文做了更谨慎的处理)

① 我们持有一家公司100%的股权

② 公司的初始净资产是200万

③ 未来十年,每年的净利润为净资产的12%,即净资产收益率ROE=12%,

④ 未来十年,公司股票的价格永远是净资产的125%,即市净率PB=1.25,则市盈率PE=11.25。

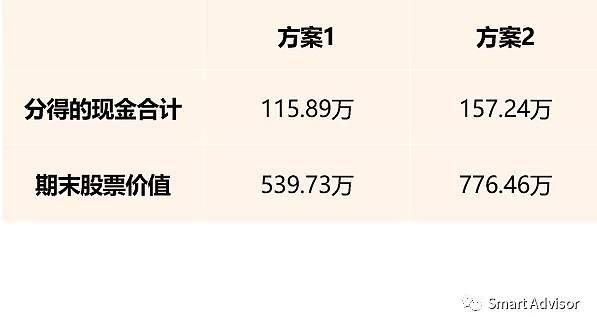

方案1:每年把净利润的1/3用作分红,用于日常开支,2/3留存在企业继续经营。这看起来是一个合理的让人皆大欢喜的分红策略。

10年后,公司的净资产为431.78万。

作为100%的大股东,我们持有的股份价值为539.93万元(相当于股份价值每年按照8%的速度增长),过去十年累计分红一共拿了115.8万元(相当于股息每年按照8%的速度增长)

方案2:不分红,每年卖出3.2%的股权,用于日常开支。

10年后,公司的净资产为621.17万元。

10年后,我们的股权份额为71.2%,对应的股份价值为776.46万元(相当于持有的股份每年按照12%的速度增长);过去10年,累计获得的现金为157.24万元(相当于按照每年12%的速度增长率)

胜负显而易见——

巴菲特的这个例子说明了:相较于以“高股息”作为标准来选择投资标的,立足基本面,选择“稳定增长”的标的是一个更加有效的投资策略。当然,巴菲特的很多持仓都具有高股息的特点,但这绝对不是他选择股票的出发点,或者说是主要维度。

对于想要稳定现金流的投资者来说,“抛售策略”也是不错的选择。

之后我们会为大家盘点“高股息策略”的指数基金。

谢谢阅读

附:巴菲特《致伯克希尔股东的信》中对“股息”的讨论:——2013年4月30日发布

Dividends

A number of Berkshire shareholders – including some of my good friends – would like Berkshire to pay a cash dividend. It puzzles them that we relish the dividends we receive from most of the stocks that Berkshire owns, but pay out nothing ourselves. So let’s examine when dividends do and don’t make sense for shareholders.

股息

伯克希尔的许多股东(包括我的一些好朋友)希望伯克希尔支付现金股利。令他们感到困惑的是,我们喜欢从伯克希尔持有的大多数股票中获得的股息,但自己却不支付给股东。因此,让我们研究一下何时分红对股东没有意义。

A profitable company can allocate its earnings in various ways (which are not mutually exclusive). A company’s management should first examine reinvestment possibilities offered by its current business – projects to become more efficient, expand territorially, extend and improve product lines or to otherwise widen the economic moat separating the company from its competitors.

盈利的公司可以通过各种方式(不是互相排斥的)分配收益。公司的管理层应首先研究其当前业务所提供的再投资可能性,即提高效率,扩大市场份额,扩展和改善产品线,或扩大将公司与竞争对手分开的经济护城河。

I ask the managers of our subsidiaries to unendingly focus on moat-widening opportunities, and they find many that make economic sense. But sometimes our managers misfire. The usual cause of failure is that they start with the answer they want and then work backwards to find a supporting rationale. Of course, the process is subconscious; that’s what makes it so dangerous.

我要求我们子公司的经理们不断地关注扩大护城河的机会,他们发现许多具有经济意义的机会。但是有时候我们的经理人会失败。失败的通常原因是他们从想要的答案开始,然后反推以找到支持的理由。当然,这个过程是潜意识的;这就是为什么这种思维模式如此危险的原因。

Your chairman has not been free of this sin. In Berkshire’s 1986 annual report, I described how twenty years of management effort and capital improvements in our original textile business were an exercise in futility. I wanted the business to succeed and wished my way into a series of bad decisions. (I even bought another New England textile company.) But wishing makes dreams come true only in Disney movies; it’s poison in business.

您们的董事长还没有摆脱这种罪恶。在伯克希尔(Berkshire)1986年的年度报告中,我描述了我们最初的纺织品业务二十年的管理工作和资本改进如何是徒劳的。我希望业务成功,并让这种希望引导自己做出一系列错误决定。(我甚至买了另一家新英格兰纺织公司。)但是,只有在迪斯尼电影中,希望才能让梦想实现。这是商业上的毒药。

Despite such past miscues, our first priority with available funds will always be to examine whether they can be intelligently deployed in our various businesses. Our record $12.1 billion of fixed-asset investments and bolt- on acquisitions in 2012 demonstrate that this is a fertile field for capital allocation at Berkshire. And here we have an advantage: Because we operate in so many areas of the economy, we enjoy a range of choices far wider than that open to most corporations. In deciding what to do, we can water the flowers and skip over the weeds.

尽管过去有过这样的错误,我们在使用可用资金方面的首要任务始终是检查它们是否可以被聪明地部署到我们的各种业务中。2012年,我们创纪录的121亿美元固定资产投资和并购交易表明,这是伯克希尔哈撒韦进行资本配置的沃土。在这里,我们有一个优势:因为我们在如此众多的经济领域中开展业务,所以我们享有的选择范围远远超出了大多数公司的选择范围。在决定要做什么时,我们可以浇花,并越过杂草。

Even after we deploy hefty amounts of capital in our current operations, Berkshire will regularly generate a lot of additional cash. Our next step, therefore, is to search for acquisitions unrelated to our current businesses. Here our test is simple: Do Charlie and I think we can effect a transaction that is likely to leave our shareholders wealthier on a per-share basis than they were prior to the acquisition?

即使我们在目前的运营中投入了大量资金,伯克希尔也会定期产生大量额外现金。因此,我们的下一步是寻找与我们当前业务无关的收购。在这里,我们的检验很简单:查理和我是否认为我们可以进行一项可能使股东的每股收益比收购前更富有的交易?

I have made plenty of mistakes in acquisitions and will make more. Overall, however, our record is satisfactory, which means that our shareholders are far wealthier today than they would be if the funds we used for acquisitions had instead been devoted to share repurchases or dividends.

我在收购中犯了很多错误,而且还会犯更多错误。但是,总的来说,我们的记录令人满意,这意味着今天的股东比我们用于收购的资金专门用于股票回购或分红的人要富有得多。

But, to use the standard disclaimer, past performance is no guarantee of future results. That’s particularly true at Berkshire: Because of our present size, making acquisitions that are both meaningful and sensible is now more difficult than it has been during most of our years.

但是,使用标准免责声明,过去的表现并不能保证未来的结果。在伯克希尔,尤其是这样:由于我们目前的规模,因此进行有意义且明智的收购比现在大多数年都更加困难。

Nevertheless, a large deal still offers us possibilities to add materially to per-share intrinsic value. BNSF is a case in point: It is now worth considerably more than our carrying value. Had we instead allocated the funds required for this purchase to dividends or repurchases, you and I would have been worse off. Though large transactions of the BNSF kind will be rare, there are still some whales in the ocean.

尽管如此,大量交易仍然为我们提供了实质性地增加每股内在价值的可能性。BNSF就是一个很好的例子:现在,它的价值远远超过我们的账面价值。如果我们改为将此次购买所需的资金分配给股息或回购,那么您和我的情况会更糟。尽管BNSF类的大型交易很少见,但海洋中仍然有一些鲸鱼。

The third use of funds-repurchases-is sensible for a company when its shares sell at a meaningful discount to conservatively calculated intrinsic value. Indeed, disciplined repurchases are the surest way to use funds intelligently: It’s hard to go wrong when you’re buying dollar bills for 80¢ or less. We explained our criteria for repurchases in last year’s report and, if the opportunity presents itself, we will buy large quantities of our stock. We originally said we would not pay more than 110% of book value, but that proved unrealistic. Therefore, we increased the limit to 120% in December when a large block became available at about 116% of book value.

当公司目前的股票卖出价格在以相对于保守计算的内在价值基础上还有实质性折让的时候,对公司而言,第三种资金用途——股份回购是有意义的。确实,有纪律的回购是明智地使用资金的最可靠方法: 当您以80美分或以下的价格购买1美元面值钞票时,就不会出错。我们在去年的报告中解释了我们的回购标准,如果有机会,我们将大量购买自己的股票。我们最初说过,我们不会支付账面价值的110%以上,但这被证明是不现实的。因此,当有一大部分可以以约为账面价值的116%回购时,我们在12月将上限提高到120%。

But never forget: In repurchase decisions, price is all-important. Value is destroyed when purchases are made above intrinsic value. The directors and I believe that continuing shareholders are benefitted in a meaningful way by purchases up to our 120% limit.

但永远不要忘记:在回购决策中,价格至关重要。当购买的商品超过内在价值时,价值便会被破坏。董事们和我相信,通过购买不超过我们账面价值120%上限的股票,这是可以使股东受益的有意义的方式。

And that brings us to dividends. Here we have to make a few assumptions and use some math. The numbers will require careful reading, but they are essential to understanding the case for and against dividends. So bear with me.

接下来,我们讨论一下“分红”。在这里,我们必须做一些假设并使用一些数学运算。这些数字需要仔细阅读,但对于理解红利的情况至关重要。所以,请忍受我。

We’ll start by assuming that you and I are the equal owners of a business with $2 million of net worth. The business earns 12% on tangible net worth – $240,000 – and can reasonably expect to earn the same 12% on reinvested earnings. Furthermore, there are outsiders who always wish to buy into our business at 125% of net worth. Therefore, the value of what we each own is now $1.25 million.

首先,假设您和我是一家拥有200万美元净资产的企业的平等所有者。该企业在净资产的基础上获得的回报率为12%,即240,000美元,并且可以合理地预期将回报进行再投资的收益也将达到12%。此外,有些局外人总是希望以净资产的125%买入我们的业务。因此,我们每个人拥有的价值现在为125万美元。

You would like to have the two of us shareholders receive one-third of our company’s annual earnings and have two-thirds be reinvested. That plan, you feel, will nicely balance your needs for both current income and capital growth. So you suggest that we pay out $80,000 of current earnings and retain $160,000 to increase the future earnings of the business. In the first year, your dividend would be $40,000, and as earnings grew and the one- third payout was maintained, so too would your dividend. In total, dividends and stock value would increase 8% each year (12% earned on net worth less 4% of net worth paid out).

您希望我们两个股东获得公司年收入的三分之一,并有三分之二进行再投资。您认为该计划将很好地平衡您当前收入和资本增长的需求。因此,您建议我们支付80,000美元的当前收益,并保留160,000美元以增加业务的未来收益。在第一年,您的股息为40,000美元,并且随着收入的增长和三分之一的派息得以维持,您的股息也将保持不变。总体而言,股息和股票价值每年将增加8%(净资产收益12%减去已支付净资产的4%)。

After ten years our company would have a net worth of $4,317,850 (the original $2 million compounded at 8%) and your dividend in the upcoming year would be $86,357. Each of us would have shares worth $2,698,656 (125% of our half of the company’s net worth). And we would live happily ever after – with dividends and the value of our stock continuing to grow at 8% annually.

十年后,我们公司的净资产为4,317,850美元(最初的200万美元按8%的比例复利),来年的股息为86,357美元。我们每个人的股票价值为2,698,656美元(占公司净资产一半的125%)。从此以后,我们将过上幸福的生活–股息和我们的股票价值继续以每年8%的速度增长。

There is an alternative approach, however, that would leave us even happier. Under this scenario, we would leave all earnings in the company and each sell 3.2% of our shares annually. Since the shares would be sold at 125% of book value, this approach would produce the same $40,000 of cash initially, a sum that would grow annually. Call this option the “sell-off” approach.

然而,还有另一种方法可以使我们更加快乐。在这种情况下,我们将把所有收益留在公司中,每年出售3.2%的股份。由于股票将按账面价值的125%出售,因此这种方法最初将产生相同的40,000美元现金,并且该金额每年将增长。将此选项称为“抛售”方法。

Under this “sell-off” scenario, the net worth of our company increases to $6,211,696 after ten years ($2 million compounded at 12%). Because we would be selling shares each year, our percentage ownership would have declined, and, after ten years, we would each own 36.12% of the business. Even so, your share of the net worth of the company at that time would be $2,243,540. And, remember, every dollar of net worth attributable to each of us can be sold for $1.25. Therefore, the market value of your remaining shares would be $2,804,425, about 4% greater than the value of your shares if we had followed the dividend approach.

在这种“抛售”情况下,我们公司的净资产在十年后增加到6,211,696美元(200万美元,复合增长率为12%)。因为我们每年都会出售股票,所以我们的持股比例将下降,十年后,我们将各自拥有该业务的36.12%。即使这样,您当时在公司净资产中所占的份额也将为$ 2,243,540。而且,请记住,归属于我们每个人的每一美元净资产都可以1.25美元的价格出售。因此,您剩余的股票的市场价值将为$ 2,804,425,如果我们采用股息方法,则比您的股票的价值高约4%。

Moreover, your annual cash receipts from the sell-off policy would now be running 4% more than you would have received under the dividend scenario. Voila! – you would have both more cash to spend annually and more capital value.

此外,您从抛售政策获得的年度现金收入现在将比股息方案下的收入高出4%。瞧!—您既有更多的现金可用于每年支出,又有更多的资本价值。

This calculation, of course, assumes that our hypothetical company can earn an average of 12% annually on net worth and that its shareholders can sell their shares for an average of 125% of book value. To that point, the S&P 500 earns considerably more than 12% on net worth and sells at a price far above 125% of that net worth. Both assumptions also seem reasonable for Berkshire, though certainly not assured.

当然,此计算假设我们的假设公司的年均净资产收益率为12%,其股东可以平均账面价值的125%出售其股份。在这一点上,标准普尔500指数的净资产收益远远超过12%,而其价格远高于其净资产的125%。对于伯克希尔公司来说,这两种假设似乎都是合理的,尽管当然不能保证。

Moreover, on the plus side, there also is a possibility that the assumptions will be exceeded. If they are, the argument for the sell-off policy becomes even stronger. Over Berkshire’s history – admittedly one that won’t come close to being repeated – the sell-off policy would have produced results for shareholders dramatically superior to the dividend policy.

此外,从积极的一面来看,也有可能超出假设。如果真是这样,那么抛售政策的论点就更加强。纵观伯克希尔的历史-公认的历史几乎不会重复-抛售政策将为股东带来明显优于股息政策的业绩。

Aside from the favorable math, there are two further – and important – arguments for a sell-off policy. First, dividends impose a specific cash-out policy upon all shareholders. If, say, 40% of earnings is the policy, those who wish 30% or 50% will be thwarted. Our 600,000 shareholders cover the waterfront in their desires for cash. It is safe to say, however, that a great many of them – perhaps even most of them – are in a net-savings mode and logically should prefer no payment at all.

除了有利的数学运算外,还有另外两个重要的理由提出抛售政策。首先,分红在所有股东施加特定的套现策略。如果说,收入的40%是政策,那些谁希望30%或50%将被挫败。我们的600,000名股东渴望获得现金,从而覆盖了滨水区。可以肯定地说,其中很多(也许甚至大多数)都处于净储蓄模式,从逻辑上讲应该根本不愿付款。

The sell-off alternative, on the other hand, lets each shareholder make his own choice between cash receipts and capital build-up. One shareholder can elect to cash out, say, 60% of annual earnings while other shareholders elect 20% or nothing at all. Of course, a shareholder in our dividend-paying scenario could turn around and use his dividends to purchase more shares. But he would take a beating in doing so: He would both incur taxes and also pay a 25% premium to get his dividend reinvested. (Keep remembering, open-market purchases of the stock take place at 125% of book value.)

另一方面,抛售方案使每个股东在现金收入和资本积累之间做出自己的选择。例如,一个股东可以选择套现60%的年收入,而其他股东可以选择套现20%或什么也没有。当然,在我们的股利分配方案中,股东可以转而使用其股利购买更多股票。但是他这样做会受到打击:他既要缴税,又要支付25%的溢价才能将其股息再投资。(请记住,在公开市场上购买股票的价格是账面价值的125%。)

The second disadvantage of the dividend approach is of equal importance: The tax consequences for all taxpaying shareholders are inferior – usually far inferior – to those under the sell-off program. Under the dividend program, all of the cash received by shareholders each year is taxed whereas the sell-off program results in tax on only the gain portion of the cash receipts.

股利法的第二个缺点具有同等重要的意义:对所有纳税股东的税收后果要比在抛售计划下的税收后果差(通常远不如此)。根据股息计划,股东每年收到的所有现金都应纳税,而抛售计划仅对现金收入的收益部分征税。

Let me end this math exercise – and I can hear you cheering as I put away the dentist drill – by using my own case to illustrate how a shareholder’s regular disposals of shares can be accompanied by an increased investment in his or her business. For the last seven years, I have annually given away about 41⁄4% of my Berkshire shares. Through this process, my original position of 712,497,000 B-equivalent shares (split-adjusted) has decreased to 528,525,623 shares. Clearly my ownership percentage of the company has significantly decreased.

让我结束这个数学练习。使用我自己的案例来说明股东如何定期处置股票,同时又可以增加对他或她业务的投资。在过去的七年中,我每年捐出约41⁄4%的伯克希尔股份。通过此过程,我原来的712,497,000股B等效股份(拆分后)的头寸已减少至528,525,623股。显然,我对公司的所有权比例已大大降低。

Yet my investment in the business has actually increased: The book value of my current interest in Berkshire considerably exceeds the book value attributable to my holdings of seven years ago. (The actual figures are $28.2 billion for 2005 and $40.2 billion for 2012.) In other words, I now have far more money working for me at Berkshire even though my ownership of the company has materially decreased. It’s also true that my share of both Berkshire’s intrinsic business value and the company’s normal earning power is far greater than it was in 2005. Over time, I expect this accretion of value to continue – albeit in a decidedly irregular fashion – even as I now annually give away more than 41⁄2% of my shares (the increase having occurred because I’ve recently doubled my lifetime pledges to certain foundations).

但是,我在这项业务上的投资实际上已经增加了:我目前在伯克希尔·哈撒韦公司所持股份的账面价值大大超过了我七年前持有的账面价值。(2005年的实际数字为282亿美元,2012年为402亿美元。)换句话说,即使我对公司的所有权已大大减少,我现在在伯克希尔工作的资金也要多得多。的确,我在伯克希尔的内在业务价值和公司的正常盈利能力中所占的份额都远高于2005年。随着时间的流逝,我希望这种价值的增长将继续-尽管以绝对不规则的方式-即使我现在每年捐赠超过41⁄2%的股份(之所以增加,是因为我最近对某些基金会认捐额翻了一番)。

*****

Above all, dividend policy should always be clear, consistent and rational. A capricious policy will confuse owners and drive away would-be investors. Phil Fisher put it wonderfully 54 years ago in Chapter 7 of his Common Stocks and Uncommon Profits, a book that ranks behind only The Intelligent Investor and the 1940 edition of Security Analysis in the all-time-best list for the serious investor. Phil explained that you can successfully run a restaurant that serves hamburgers or, alternatively, one that features Chinese food. But you can’t switch capriciously between the two and retain the fans of either.

最重要的是,股息政策应始终清晰,一致和合理。反复无常的政策将使所有者感到困惑,并驱逐潜在的投资者。菲利普·费雪(Philip Fisher)在54年前的《怎样选择成长股》的第7章中将其精彩地描述了出来,该书在“认真的投资者”有史以来最好的榜单中仅次于《聪明的投资者》和1940年版的《证券分析》。菲利普·费雪(Philip Fisher)解释说,您可以成功经营一家提供汉堡包的餐厅,或者提供中餐的餐厅。但是您不能在两者之间随意切换并保留其中任何一个的粉丝。

Most companies pay consistent dividends, generally trying to increase them annually and cutting them very reluctantly. Our “Big Four” portfolio companies follow this sensible and understandable approach and, in certain cases, also repurchase shares quite aggressively.

大多数公司支付稳定的股息,通常试图每年增加股息,并且非常不情愿地削减股息。我们的“四大”投资组合公司遵循这种明智和可理解的方法,在某些情况下,他们还非常积极地回购股票。

We applaud their actions and hope they continue on their present paths. We like increased dividends, and we love repurchases at appropriate prices.

我们赞扬他们的行动,并希望他们继续沿目前的道路前进。我们喜欢增加股息,我们喜欢以适当的价格进行回购。

At Berkshire, however, we have consistently followed a different approach that we know has been sensible and that we hope has been made understandable by the paragraphs you have just read. We will stick with this policy as long as we believe our assumptions about the book-value build up and the market-price premium seem reasonable. If the prospects for either factor change materially for the worse, we will re-examine our actions.

但是,在伯克希尔,我们一直采用不同的方法,我们知道这是明智的,我们希望您刚刚阅读以上段落后能够理解我们。只要我们相信我们对账面价值增长和市场价格溢价的假设似乎是合理的,我们就会坚持这一政策。如果任何一个因素的前景发生重大变化,我们将重新考虑我们的行动。

网址:关于“高股息策略”,巴菲特跟你有不同的想法(附:致股东信中关于“股息”的讨论) (全文共2600字,大约阅读8分钟)目录1.关于“股息”的基本常识2.什么是“高股息策略”3.“高股息策略”对投资者的好... https://www.yuejiaxmz.com/news/view/81254

相关内容

如何实现买入就把钱赚了? 一、策略概述。 这篇文章和昨天《高股息策略为何稳赚不赔》是并列关系,高股息策略是一种以股息率为锚的价值投资策略,通过持续...银行股的投资策略(深度好文) 银行股的投资策略(深度好文)低级投资策略银行作为百业之母,和人的生活息息相关,是我们最熟悉的行业,几乎所有企业都离不开它...

股票投资的25个常识及15个基本原则 常识1:股票投资的基础是要有“股权思维”。股票即是企业,买股票就是买生意。股票不仅仅是一种可交易的证券,而是一家企业的所...

股票投资有哪些基本策略?

14股票投资建议书,股票的投资建议怎么写

投资理财的十二大基本策略

股票投资建议书格式,股票投资方案怎么写

券商2014年A股投资策略

民间股神林园:投资就是买垄断 #雪球投资人访谈系列# @林园 林园雪球个人页:网页链接 提到林园,A股的老股民几乎无人不知。这个曾经被誉为“中国民间股...

巴菲特股东大会问答——关于投资、生活的建议 1、做自己喜欢的事情会成功1997年股东大会问答,夏青书,来自中国,目前居住在堪萨斯州。问:如果有人想成立一家像你30或...